Ipo Meaning in Business

However The Boring Company fits the mold of disruptive business models that the Fool typically recommends. Get updates on latest IPOs news and all the information on upcoming initial public offering with all the initial public offering news and IPO calendar on a single platform with ease - Moneycontrol.

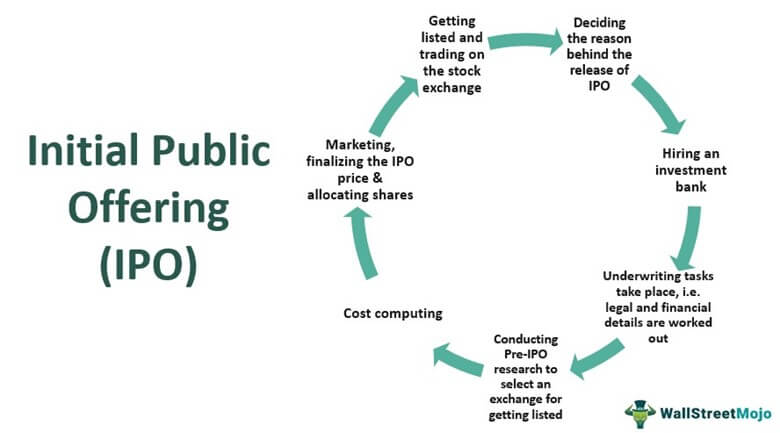

Initial Public Offering Ipo Definition Process How It Works

Standing or pointing straight up or at an angle of 90 to a horizontal surface or line.

. The business intends to distribute preferred dividends Preferred Dividends Preferred dividends refer to the amount of dividends payable on preferred stock from profits earned by the company and preferred stockholders have priority in receiving such dividends over common stockholders. Get business latest news breaking news latest updates live news top headlines latest finance news breaking business news top news. Premium IPO advisers say they dont expect 2022 to follow that pattern meaning it could end up being the worst year for raising money in IPOs since Dealogic a research firm started tracking.

In the second quarter Duolingo continued. The IPO opens on Mar 15 2021 and closes on Mar 17 2021. The Dotcom Bubble was an economic bubble that affected the prices of stocks related to the technology industry during the late 1990s and early 2000s in the United States.

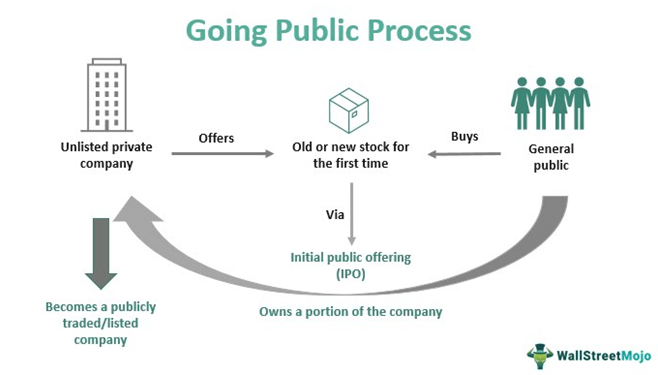

The stocks of this type of company belong to members of the general public as well as pension funds and other large investing organizations. A small portion of. The funding round meaning refers to the rounds of funding that startups go through to raise capital.

As the Tax Court has stated when interpreting the meaning of business under. Craftsman Automation IPO is a main-board IPO of equity shares of the face value of 5 aggregating up to 82370 Crores. Last year I didnt buy Duolingo stock primarily because I believed it was a high-churn business unlikely to consistently grow its paying-subscriber base.

The issue is priced at 1488 to 1490 per share. The issue is priced at 443 to 453 per share. A bond is a fixed income investment in which an investor loans money to an entity typically corporate or governmental which borrows the funds for a defined period of time at a variable or.

Tega Industries IPO is a main-board IPO of 13669478 equity shares of the face value of 10 aggregating up to 61923 Crores. An IPO could raise 10 billion in a sale of 15 of the business plus 17 billion of debt according to the Wall Street Journal. This document includes the nature of business risks strengths weaknesses promoters and more.

You are on the home page of Indias premier IPO news and research platform. 1-Raising private capital from angel investors andor venture capital firms. Fool newsletter subscribers are notoriously long-term minded and rarely sell meaning the stock price will continue to rise.

When the Motley Fool recommends a company there is usually an immediate spike in the price. The IPO opens on Dec 1 2021 and closes on Dec 3 2021. The business model of a private accelerator can be summarized as the following.

Meaning of the Term Business For purposes of IRC 501c6 the term business is construed broadly. The stock can be released only after the SEBI approval comes through. Business members may have a variety of interests they must have a common interest Purpose of a business nature that the organization promotes.

The companies that get SEBIs go-ahead will come with an IPO. As the business will have a very limited track record the risk is higher as compared to a more established business. The event was triggered by the hype over the new Internet industry media attention and investors speculation of profits by dot-com companies.

There are the companies that are coming with Upcoming IPOs 2022 in India might be Aadhar Housing Finance Arohan Financial Services Utkarsh Small Finance Bank Jana Small Finance Bank Seven Islands Shipping Jaikumar Constructions NCDEX ESAF Small Finance Bank Apeejay Surrendra Park Hotels. If you are new to IPOs please check IPO news regularly and you might also. The visibility of the company increases as well.

If a registrant is a successor registrant it shall be deemed to have satisfied conditions A B C and D2 above if. Get to learn Share Market Meaning different types of Share Market like Primary Secondary Share Market much more to get you ready for the share market. IPO Watch - Find Latest Upcoming IPOs List 2022.

We also provide updated information on buybacks and NCD offersCheck out our dedicated sections on IPO Updates SEBI Approval Status IPO Calendar IPO Review Grey Market Movements and IPO Allotment Status. Link Intime India Private Ltd is the registrar for the IPO. Read more of 20 per share for infinite tenure.

Link Intime India Private Ltd is the registrar for the IPO. The startup companys value will be determined based on the quality of the. What is the Business Model of a Startup Accelerator.

The minimum order quantity is 10 Shares. Also known as a publicly traded company publicly held company or public corporation. Registering an offering that effectuates a business combination transaction as defined in Rule 165f1 230165f1 of this chapter.

The company gets listed on the stock exchange after IPO and this provides an opportunity to even a common man to invest in the company. The minimum order quantity is 33 Shares. A public company is a business whose shares can be freely traded on a stock exchange or over-the-counter.

Going Public Meaning Steps Example How It Works

The Stock Market Archives Napkin Finance Finance Investing Financial Literacy Lessons Economics Lessons

Initial Public Offering Ipo Explained Westpac

:max_bytes(150000):strip_icc()/IPO-final-0a0a9ea9c5be4c1082332426db768005.png)

Initial Public Offering Ipo What It Is And How It Works

0 Response to "Ipo Meaning in Business"

Post a Comment